What is M1 Finance?

At the heart of M1 Finance is the use of portfolio templates called pies. These pies are based on the Modern Portfolio Theory or MPT. Introduced in 1952 by economist Harry Markowitz, MPT is sometimes referred to as mean-variance analysis. It’s a mathematical framework for assembling a portfolio of assets where an expected return is maximized for a given level of risk. Further, it says an asset’s risk and return should never be assessed itself, but rather by how it contributes to a portfolio’s overall risk and return. Circling back to M1 Finance, investors can select a pie that matches their financial goals. The company manages the account by maintaining the pie allocations through both rebalancing your portfolio and the allocation of new funds from dividends or new deposits to the service. Because you can choose the investments for your pies, M1 Finance isn’t considered only a Robo advisor. You can also buy individual stocks and exchange-traded funds or ETFs.

Available Options

As an M1 Finance investor, there is no minimum investment requirement and no fees. Accounts are limited to individual, joint, Traditional IRA, Roth IRA, Rollover IRA, and SEP IRA. You can also set up trusts through the service.

Getting Started with M1 Finance

Opening an M1 Finance account requires only a few minutes of your time, as you can see below.

Once you verify your email address: From there, you’ll be asked a series of questions about your income, financial worth, and risk tolerance. The final step is to add your social security number. You can then fund your account instantly or manually, depending on the instructions available for your bank.

Building Your Portfolio

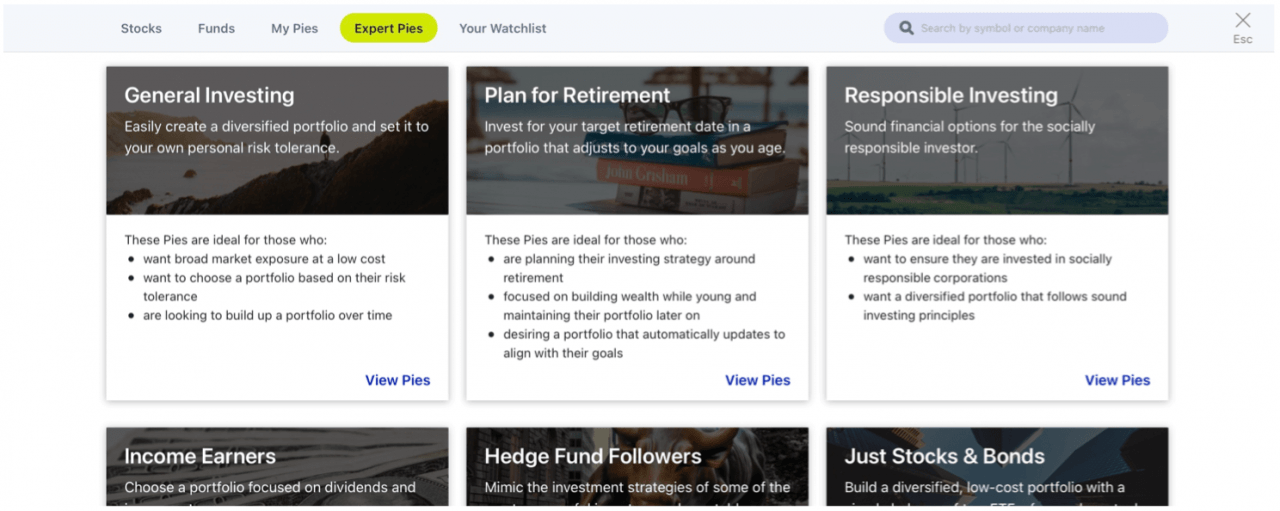

Once you set up your M1 Financing account, you can begin browsing the company’s growing list of expert pies or search for securities, including stocks and EFTs (Mutual funds are not supported at this time.) Pies are available in multiple categories, including General Investing, Plan for Retirement, Hedge Fund Followers, and more. Once you select a category, you can drill down further to select your pie. Each one includes several holdings or slices. For these, you can see the dividend yield, performance at 1Y, 3Y, and 5Y, and risk.

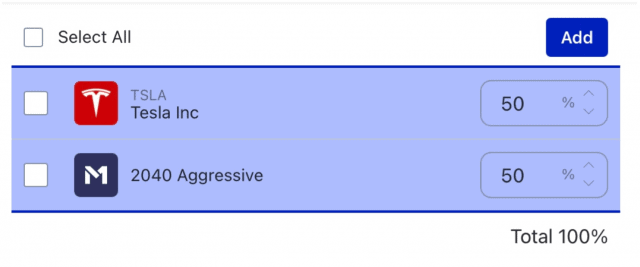

You aren’t limited by the number of pies or securities to buy. As money is added to your account, your overall portfolio is adjusted automatically based on your requirements. For example, you could invest 50% of your holdings in a retirement-based pie, with the other 50% going to purchase Tesla stock. It’s your choice, and you can make changes at any time.

What’s M1 Plus?

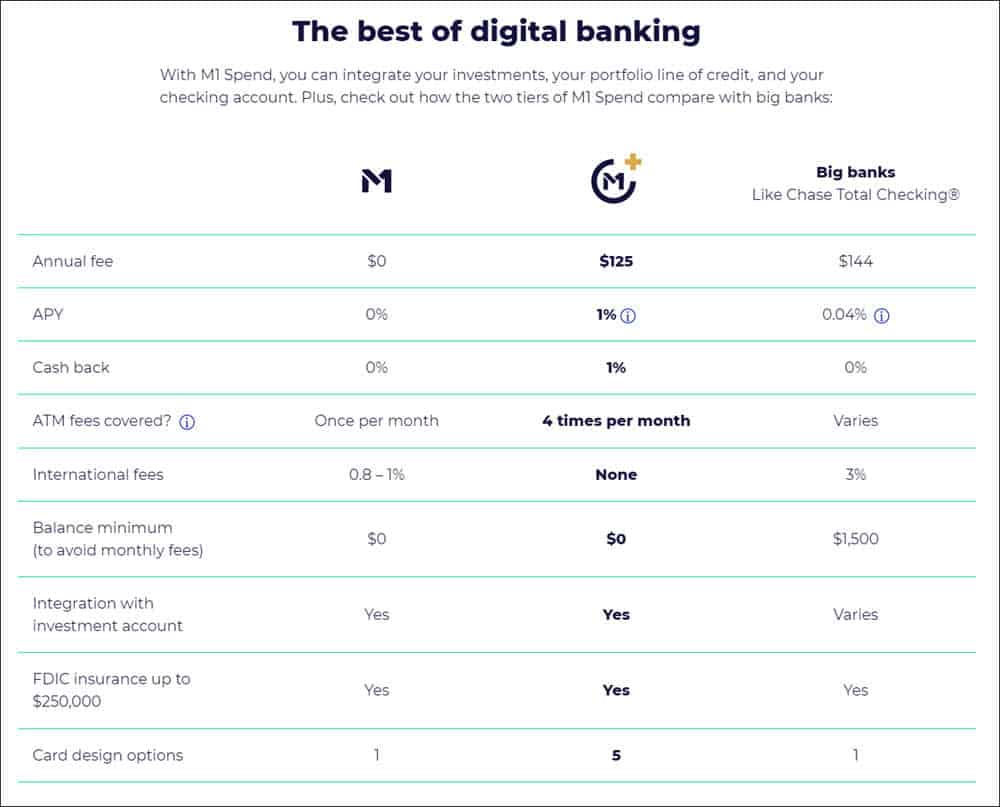

For additional premium services, you can upgrade your account to M1 Plus for $125 per year. Free for the first year, the M1 Plus account gives you several additional features including a checking account with 1% cashback on qualified purchases using your M1 Plus Visa debit card, 1% APY on cash in your account, the ability to borrow through a portfolio line of credit — aka margin (borrow up to 35% of your portfolio’s value when you have $10,000 invested), and, an afternoon trading window.

M1 Financing: Pros

There’s much to love about M1 Financing, starting with its ease of use in setting up a free account. Based on seeing the steps above, you might get the impression that signing up for an M1 Finance account is difficult. This isn’t the case on both the web and through the official app. And because you don’t have to deposit funds before creating your portfolio, there’s no pressure. You can research investment solutions at a comfortable pace and fund your account whenever you want with as little as $100. M1 Finance also receives kudos for offering fractional shares, which means even small investors can become an owner of some of the largest companies in the world. It also helps there’s no fee for buying and selling the securities in each of your pies.

M1 Financing: Cons

Day traders will want to look elsewhere for investing since M1 Financing has not been designed for active traders. And if you want to move beyond ETFs and stocks, M1 Finance isn’t your solution. Beyond this, some investors might be unhappy that M1 Financing doesn’t offer some of the services offered by its competitors like tax-loss harvesting. Without getting stuck in the weeds, TLH lets you sell securities at a loss in a way to offset capital gains tax liability. It’s useful to limit the recognition of short-term capital gains, which are taxed at a higher federal income tax in the United States. Many Robo advisors offer TLH automatically, but M1 Financing does not. Instead, it offers a tax minimization standard on all accounts. Within this standard, M1 Financing will prioritize any of your sales in such a way as to minimize your taxes. According to the company, M1 sells securities in this order:

Losses that offset future gainsLots that result in long-term gainsLots that result in short-term gains

While tax minimization is a benefit, some will argue it’s not as good as TLH. You’ll need to discuss this with your tax advisor to determine whether you can live without TLH before opening an M1 account. M1 Financial is a unique automated investment platform that might be worth your time, depending on your situation. It’s for anyone who is looking for a modern, app-based platform that can assist with both putting together an investment portfolio and helping you track and manage it in a semi-automated “Robo” fashion. Honestly, we really like the service and can easily understand its gaining popularity. To get started, visit the M1 Finance website to get started. Comment Name * Email *

Δ Save my name and email and send me emails as new comments are made to this post.

![]()